- Sinch Community

- Numbers & Connectivity

- US Short Codes

- How can I get a short code?

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

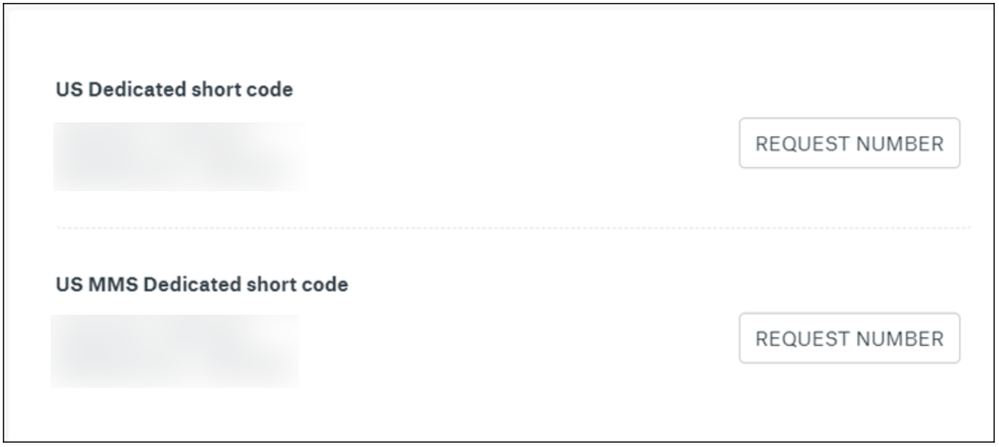

To get a short code, take the following steps:

- Go to your Sinch Customer Dashboard.

- Follow these instructions to search for a virtual number.

- Click REQUEST NUMBER for either SMS or MMS, depending on your need.

- Enter the requested information and follow the remaining prompts to request a short code number.

Click here to learn more about how you can get access to a complete range of carefully-tested phone numbers, to use with all your communication services from Sinch.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

To lease a US short code, the CTIA and the US Short Code Registry now require brands and content providers to undergo vetting by providing their organization information. This information will be reviewed by Aegis Mobile, CTIA’s vetting partner, thus enhancing transparency and consumer protection.

Brands and content providers need to be registered and vetted only once, with short code leasing available post-vetting. In subsequent years, the point of contact on file must complete annual email verification.

The following information will be required:

- Legal Company Name

- Legal Entity Type

- Doing Business As

- Country of Registration

- Stock Market Symbol

- Company Website URL

- Federal Tax ID

- DUNS, GIIN, LEI (if applicable)

- Physical Address

- Country

- Street Address

- City

- State/Province

- Zip/Postal Code

- Brand Client/Content Provider Point of Contact

- First Name

- Last Name

- Phone Number

What is the difference between a Brand and a Content Provider?

CTIA and the Short Code Registry has defined content provider as the entity that has a contractual relationship with the brand sending messages.

How about existing short codes?

Brand and content provider with short codes on auto-renewal must register their organization information and complete the new vetting process by Q1 2025. Parties will have sixty (60) days after the auto-renewal date to update the required fields.

Sinch has started collecting this information. Please contact your account manager if you have any questions.

Are vetting statuses transferable?

No, vetting statuses are not transferrable. In the event of a lease transfer, new information must be submitted, and entities will need to undergo vetting again.

Vetting Process Overview

Upon submission of the brand information, the vetting party will review the following triage criteria:

- Legal name matches FEIN

- POC contact email is valid

- POC email domain relate to the company’s published URL

- If triage criteria are not met, an incomplete status will be issued without further processing

Once triaged criteria are met, the Point of Contact (POC) on file will receive an email from Aegis Mobile (certify@aegismobile.com). This email will contain a PIN and instructions on how to complete the registration. Be sure to check your junk mail folder.

The PIN is valid for 7 days. A reminder email will be sent 48 hours before the PIN expires. If the initial PIN expires, Aegis Mobile will issue a second and final PIN.

While the POCs completes the PIN verification, the vetting party will continue to review the remaining brand details at the same time.

Vetting Statuses:

- Successful Status – Indicates that the vetting activities were completed with acceptable results. A Successful vet status is retained for up to a year, after which renewal vetting is required to continue participating in short code messaging.

- Incomplete Status – Indicates that certain critical information does not meet the minimum requirements for completing the vetting activity. If we are unable to provide the correct information within 10 days/2 additional resubmission attempts following the Incomplete status, the status will update to Unsuccessful.

- Unsuccessful Status – Indicates that either an incomplete vet status was not resolved or that risk levels were unallowable based on discovered past behaviors.

Tips to a Successful Vetting Results

- Ensure that the Federal Tax ID matches the exact Legal Company Name registered with the IRS.

- Use FEIN and Legal Company Name shown on the first line of CP-575/EIN Confirmation Letter.

- The physical address entered should also match what is registered with the IRS. If the information does not exactly match the EIN Confirmation Letter, your vet will be in an Incomplete state and you will not be able to lease the short code until the issue is resolved.

- Ensure email address and website URL provided matches the company being vetted.

For entities with international presence, please specify the Tax ID and the country of registration. For entities in Canada, please provide the first 9 numeric digits of the Business Number (BN-9) when providing brand client details.

US Tax ID, company name and address can be validated using the following resources:

- Public business entities: Public business lookup (EDGAR)

- Nonprofit entities: IRS Tax Exempt Organization Search

- Private business entities: If you are a private business in the US, here is a list of private business lookup by state:

|

State |

Lookup Database Title |

|

Alabama |

|

|

Alaska |

|

|

Arizona |

|

|

Arkansas |

|

|

California |

|

|

Colorado |

|

|

Connecticut |

|

|

Delaware |

|

|

District of Columbia |

District of Columbia Business Filings Search (login required) |

|

Florida |

|

|

Georgia |

|

|

Hawaii |

|

|

Idaho |

|

|

Illinois |

|

|

Indiana |

|

|

Iowa |

|

|

Kansas |

|

|

Kentucky |

|

|

Louisiana |

|

|

Maine |

|

|

Maryland |

|

|

Massachusetts |

|

|

Michigan |

|

|

Minnesota |

|

|

Mississippi |

|

|

Missouri |

|

|

Montana |

|

|

Nebraska |

|

|

Nevada |

|

|

New Hampshire |

|

|

New Jersey |

|

|

New Mexico |

|

|

New York |

|

|

North Carolina |

|

|

North Dakota |

|

|

Ohio |

|

|

Oklahoma |

|

|

Oregon |

|

|

Pennsylvania |

|

|

Puerto Rico |

|

|

Rhode Island |

|

|

South Carolina |

|

|

South Dakota |

|

|

Tennessee |

|

|

Texas |

|

|

Utah |

|

|

Vermont |

|

|

Virginia |

|

|

Washington |

|

|

West Virginia |

|

|

Wisconsin |

|

|

Wyoming |

Canadian Tax ID, company name and address can be validated using the following resources:

Europe, Eastern Europe, North Atlantic, Middle East, South America, and APAC Tax ID, company name and address can be validated using the following resources:

- Europe: VIES VAT number validation - European Commission

- Australia: Australian Business Register (ABN) lookup Note: provide your ABN (Australian Business Number) not your ACN (Australian Company Number) as your Tax ID for brand registration purposes.

For more information, please check out CTIA and The Short Code Registry's FAQs page or their summary below: