- Sinch Community

- Numbers & Connectivity

- 10DLC

- How do I enter the correct Tax ID for 10DLC brand registration?

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

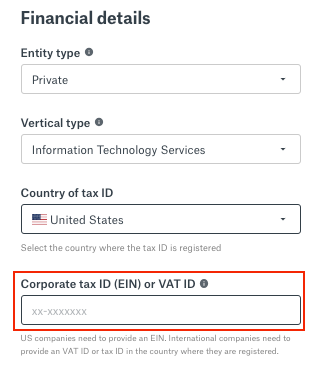

Here are some helpful tips on how to provide the correct Tax ID during the 10DLC brand registration process.

How to enter the correct Tax ID

United States

If you are a US company or a foreign company with a US IRS Employer Identification Number (EIN), provide your nine-digit EIN in the Tax ID field during brand registration.

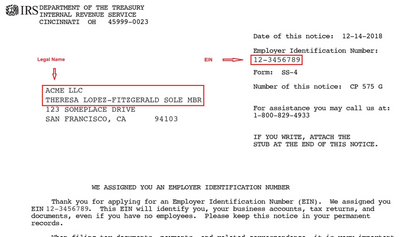

Make sure that your legal company name matches your IRS registration and is spelled correctly. The address you enter should also be the same that is used in registering with the IRS. The correct information for registration can be found on your company's IRS EIN confirmation letter (SS-4).

Example EIN confirmation letter:

If you do not enter the information exactly as it appears on your EIN confirmation letter, your Brand will be in an unverified state and you will not be able to register a campaign until this is resolved. Thus, as stated above, the information you enter must match your EIN information.

Canada

If your primary business registration is in Canada, please enter one of the following tax IDs:

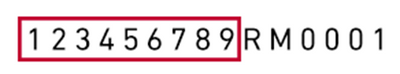

- Your Canadian Business Number (BN) that was issued by the CRA. Please only enter the first 9 numeric digits. Here's an example (only enter what is in the red box):

- Your Corporation/Incorporation Number

- Your Registry ID

Make sure your legal company name is consistent with your corporation registration and is properly spelled. The address you enter should also be the same as that used in registering with Corporations Canada. You can use the following free resources to check that you've entered the correct info:

For more guidance and resources on how to provide the correct brand information for 10DLC brand registration, make sure to check out the 10DLC Brand Identity Resources article.

Visit the Sinch 10DLC Product Page to learn more about Sinch 10DLC or if you need more help with 10DLC or have any questions, contact Sinch, who will be happy help!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content